Best Places to Get a Small Business Loan For Business in 2023

Business loan is helpful for businesses for scaling the businesses if there is a business which you hold and you need money for growing your business and if you have the potential to earn more money then the loan interest then you should definitely go for the business loan the business loan help the businesses.

If your business is eligible for business loan then you should calculate the EMI of your business loan amount and the insurance cover and various other features for business loan business loan interest rate is different for small medium and large businesses so you should check it properly before opting for the business loan and if there is any charge you should also check it so for operation of your business is your business loan will be helpful for you you for getting more profits and for your management of your business.

Contents

Business Loan Online at Lowest Interest Rate

If you are a business owner and you want to expand your business and four expanding of your business you need a fund for your business expansion then business loan may be the best option for you there are a lot of bank who provides the business along and there are a lot of Financial Institutions are also who provide the business loan for different purposes so before opting for the business loan you should check for the repayment plan of the business interest rate of the business loan and loan amount.

Microfinance Institutions and Banks for Cottage Industry/Micro/Small Business

Microfinance Banks and Microfinance Institutions are primarily a financial companies that provide small loans for all those people doing cottage industries or home industries or for all the people doing small industries if you want to do a small industry.

So you can take a loan from these micro financial institutions or banks, all of you will get this loan from any microfinance institution near you, for this you need to follow their eligibility criteria and then you will apply for the loan.

Best Business Loan Provider at Lowest Interest Rate

Loans that will push your business ahead of the loan which will take you to the next level, you need a loan but if you want a low rate loan, then I will tell you some list of companies. This company will offer you loans at low rates. All of these companies will have your rates And will help you to expand your business if you want to expand your business in real need to expand and you have different bases. If you want to take the launch, then you approach your lenders for this, as well as you can get from this company if you want different types of loan.

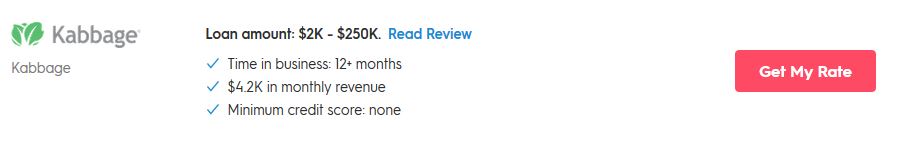

1. American Express ( Kabbage )

The app to help you manage your business’ cash flow. View your select business products and accounts1 in one place for more efficient cash flow management. get personalized data3 based on your select business products and accounts. Use this data to help you track your business’ cash flow and make more informed financial decisions with increased confidence.

The best growth forecast product which helps the product automation for business line credit which focused on growth with flexible access of business funding business checking for balancing and for payment acceptance for customers.

This company is very Ideal for you. Now whether it is small or small, you can increase your business. With the help of this company or company, you give a lot of funding so that you can easily manage your business. You should get your business’s identity and time of payment will get lots of money here. You will get lots of funding so many will meet you so that you can make your business the right way Could stabilize with.

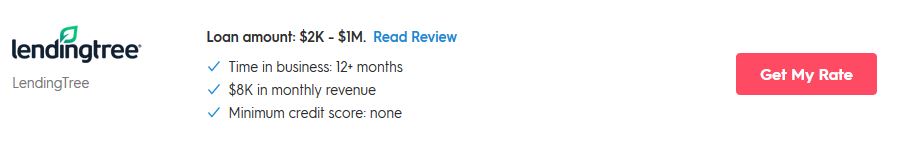

2. Lendingtree

LendingTree is a marketplace, built to save you money—we don’t make loans, we find them. In fact, we’ve been finding the best loans for Americans for more than 20 years. Our marketplace is the largest in the country, and it’s filled with lenders you know and trust.

Mortgage Refinance, Home Equity Loans, Credit Cards, Mortgage Calculator, Personal Loans, Auto Loans, Free Credit Score, Insurance and Student Loan Refinance.

This will make your business easier, as well as it will provide you with very little protection. If you want funding, then you should definitely contact this company. This company provides loans at a very low rate and your torso is almost too long. You can repay your money for 5 years with partner, you can take help from this company to increase your business.

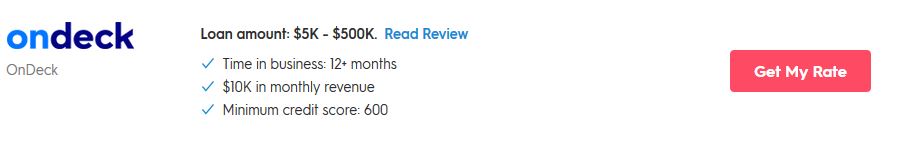

3. Ondeck

Small business l ending that’s fast and easy. Your business needs options. We’ve got different loans available for you.

- OnDeck Line of Credit – Use for managing cash flow, such as buying inventory or making payroll Get a revolving credit line, with access to cash when you need it.

- OnDeck Term Loan – Use for investments in your business, such as expansion projects or large purchases Get a one-time lump sum of cash upfront, with the option to apply for more when you’re halfway paid down.

You should want to increase your business now want to increase your revenues. You want to paint your business at a good level, then you must definitely apply for business for this. You can display the amount of your loan according to your business. Apply for business loan if your business qualifies, loans will definitely be provided for different types of business, The feeling is the interest rate and to know more about yourself.

- Step 1. Complete the application – Our application is pretty simple, and you can apply online or over the phone.

- Step 2. Get a decision – Your dedicated loan advisor will review your options with you.

- Step 3. Receive your funds – Complete the online checkout and receive your funds as soon as the same day.

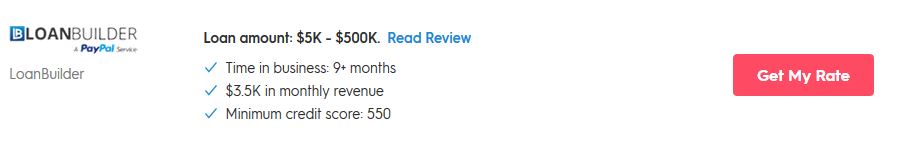

4. Loanbuilder (A Paypal Service)

Build the loan that’s right for your business. Single fixed fee pricing and no origination fee. Build your perfect loan

- Tailored terms – Choose the loan amount and term that fit your business needs.

- Clear competitive pricing – There is no origination fee and no early repayment fees, just one single fixed fee.

- Fast access to cash – Check eligibility2 in minutes. Complete the application, and if approved, funds are transferred as fast as the next business.

If you are interested in acting, you want to increase your business and if you want to pay your business loan easily, by increasing your business, the worship company will help you in every way. This company makes your long tail easier or the company will give you Lone Provides Low Interest Rate How Much Loans Should You Need And How Many Money Can Make You Money On Your Company’s Day So You Have Been Divided You can, however, you should tell you about the company to gather more information to visit the company’s official website to get more here.

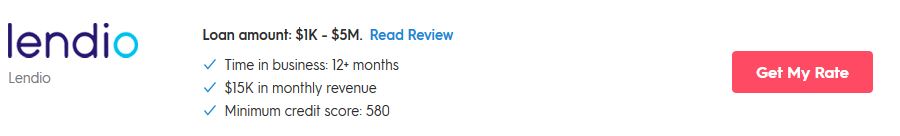

5. Lendio

Your one-stop shop for business finances. One application to funding options, and one tool to get your finances in check. Apply for a business loan in just 15 minutes. Employee Retention Tax Credit Application.

This company idea for businesses with less than Australia credit and I want to see you that if anyone wants to fill out the loan application and get offers from multiple lenders on a number of different long type then you should have to select this loan lenders because lot of benefits which is this company the funding amount of this company is going from $2000 million dollar which really help you business to stabilize and requirement for or the loans take at least 6 month and have a a minimum revenue and there is really no minimum credit score required all the individual cylinders may have their own credit requirements to get the lawn.

Conclusion

I have told all the people about some top company. I tell all people what type of business plan is that the secured loan is better for those who are companies which deal with properties. Along with the unsecured loan which group credits make it full, the line of credit means the working capital expenditure is what is the focus loan management software.